What is the January Effect? It is a term used in stock markets to describe a tendency for stocks to increase in value during the first month of the year. Many people believe that this phenomenon is caused by investors rushing to buy shares before the new year, which drives up prices.

However, there is no single answer as to why this happens. Some believe that it’s due to optimism about the future, while others think that investors are expecting more positive news about company performance in January. Whatever the reason, it’s always worth keeping an eye out for the January Effect when trading stocks.

What Is the January Effect? (Definition #2)

The January effect is a phenomenon in the stock market in which stock prices tend to rise at the beginning of the year. This effect is typically attributed to investors’ optimism about the future and their willingness to take on more risk in the new year. While the January effect has been observed in a number of different markets, it is most pronounced in the US stock market.

Theories about why the January effect exists

There are a number of theories about why the January effect exists, but the most likely explanation is that it is due to a combination of factors, including:

- The end-of-year tax-loss selling that takes place in December

- The influx of fresh capital from investors who make New Year’s resolutions to invest more in the stock market.

Proponents of this effect say that it is a psychological phenomenon caused by investors’ belief that new year’s resolutions will be fulfilled in January.

Skeptics believe that it is simply an indication that investors are optimistic about the future.

Some people believe that it is because investors sell off their stocks at the end of the year in order to book their profits and avoid paying taxes on them. This then creates a buying opportunity for investors who are looking for good deals in the new year.

Others believe that it is because investors have more money to invest at the beginning of the year, thanks to bonuses and other income they received over the holiday season. And still others believe that it is simply a case of “mean reversion,” where stocks tend to go back to their long-term average after a period of being above or below that average.

The January effect and the stock market

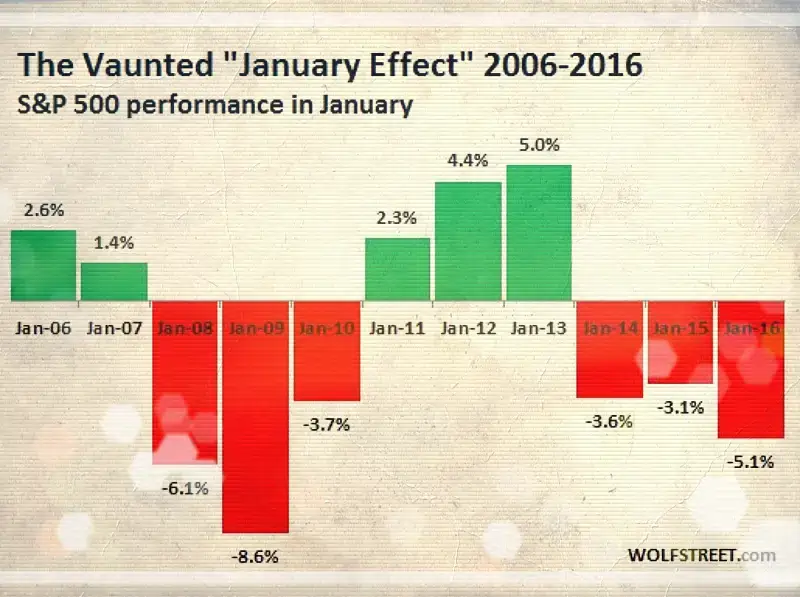

While the January effect is generally seen as a positive phenomenon, it is important to remember that it is not always guaranteed to occur. In fact, there have been a number of years in which the stock market has actually seen a decline in January.

Risks associated with the January effect

Investors who are looking to take advantage of the January effect should be aware of the potential risks involved and should only invest an amount that they are comfortable losing.

In conclusion, the January effect is a real phenomenon that takes place in stock markets all over the world. It is caused by investors who sell their stocks in December to avoid paying taxes on their gains and then buy them back in January, which drives the prices down. However, there are many factors that can affect the size and direction of the January effect, so it is important to do your own research before investing.